Private Capital For

Real Estate Investors

We are an innovative private lender helping real estate investors get more deals done. With 110+ years of experience in real estate lending, project development, ground-up construction, and more, we provide more than just capital.

When you're ready to take your real estate investing to the next level, we're here to help.

Our Secret Sauce: Diversification

40%

APPRECIATING

ASSETS

40%

PASSIVE

INCOME

20%

HIGH

REWARD

100%

DIVERSIFIED

PORTFOLIO

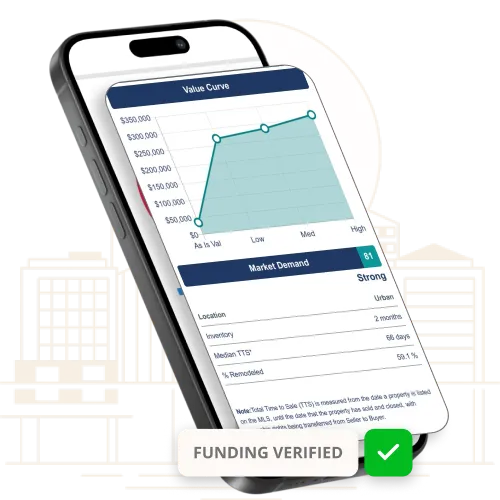

COMPETITIVE RATES / QUICK CLOSE

Need Funding For

Your Next Deal?

Look no further! When it comes to your next investment property, you need a trusted financing partner to help close the deal. Schedule a time to speak with a member of our team to walk through the steps to funding your next deal!

FLEXIBLE LOAN OPTIONS

Loans For Unique Investment Needs

Fix & Flip

We help all of our borrowers understand which deals work, which don't, and why.

New Construction

Competitive funding for new construction projects for experienced investors.

Rental Bridge Loans

Competitive short-term financing options For investors bridging the gap..

DSCR

Our tools, team, and processes help our borrowers through every deal with ease.

Refinance

Every loan and transaction our borrowers do make the next one easier and easier to do.

Bridge Loans

Bridging the gap between new property purchases and long-term financing.

SERVING YOU

Reliable Financing For Real Estate Investors

We understand the unique needs of real estate investors. That's why we offer an easy financing process and reliable capital, so you can get the funding you need quickly and efficiently. Our team of experienced professionals is here to guide you through the process, so you can get the financing you need to get the most out of your investments.

BORROWERS ELEVATED

Loans, Guidance, & Leverage

Free Guidance

We help all of our borrowers understand which deals work, which don't, and why.

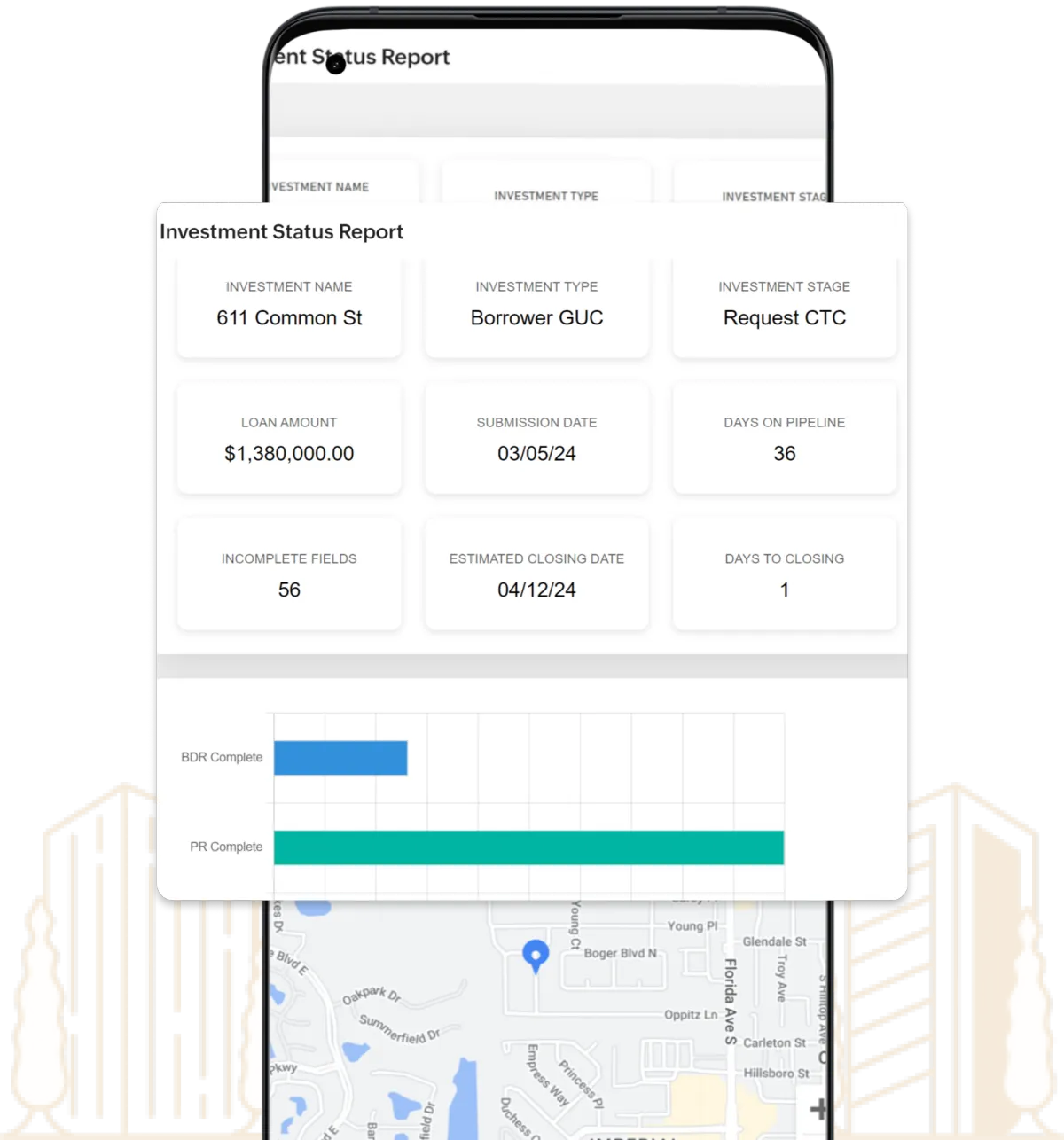

Proven Processes

Our tools, team, and processes help our borrowers through every deal with ease.

Limitless Potential

With the right lending partner in your corner you're no longer limited on how many deals you can do per year.

Lending That Scales

Every loan and transaction our borrowers do make the next one easier and easier to do.

BORROWERS ELEVATED

Loans, Guidance, & Leverage

TESTIMONIALS

Results Speak For Themselves

"I live in Vancouver and invest across the US. The exchange rate makes it necessary to leverage capital from a trusted source that acts as my partner, not just another lender. They’ve given me an extra set of eyes with 'boots on the ground diligence' to help me grow my portfolio wisely."

– Jeffery B –

Vancouver CA

"Huge thanks to HIS Capital Funding for showcasing our efforts and journey on this project. We are blessed to have the opportunity to partner with amazing firm."

– Yanira Suarez –

CEO

"Character, Integrity, Transparency, Fully Vetted Investments and Great Returns!"

– Shawn A. Sullivan –

CEO

Company

Legal

HIS Capital Funding is a private money lender providing business purpose loans for real estate investments. * We do not give tax or legal advice. Please consult an attorney, CPA, or licensed professional for your needs. All examples and case studies are for educational purposes only.